Launch, Scale, Succeed

Unlock the Potential of Fund Management Company

Create Challenges, Earn Capital, and Share Profits—The Complete Solution for Traders and Brokers Seeking Growth and Rewards

What is a Fund Management Company?

A fund management company provides traders with access to the firm’s capital, enabling them to earn a share of the profits generated through trading in financial markets.

Key Features of a Prop Trading Company:

Traders are provided with access to the firm’s funds, significantly increasing their trading power and opportunities to capture profits.

Traders earn a percentage of the profits generated through their trades, while the firm retains a share to cover its capital risk and operational expenses.

Fund management firms implement risk management protocols to safeguard capital in addition to providing training, tools, and mentorship to help traders refine their strategies and improve performance.

Fund management firms provide traders with access to capital, reduced personal financial risk, advanced tools and mentorship for growth, a profit-sharing model fostering collaborative success, and robust risk management.

Fund management firms typically attract skilled traders who have a proven track record of success or exhibit strong potential to perform in financial markets.

Step-by-Step Guide to the Prop Trading Model

Step 1

Challenges to Prove Skill

Fund management firms use structured challenges to identify talented, disciplined traders who can meet profitability targets while managing risk effectively. These challenges are designed to filter out traders who lack consistency or discipline and to find those with strong, repeatable strategies. Heres a breakdown of the challenge process:

Challenge Creation

Goal :

The firm defines the goals of the challenge, which may vary by difficulty level, profit targets, and risk limits.

Customizable Options :

Challenges often come with customizable parameters such as target profits, maximum drawdown, and daily loss limits to suit traders at different levels.

Risk Parameters

Daily and Overall Loss Limits:

Firms set strict rules on the maximum daily and overall loss that traders can incur, ensuring risk is tightly controlled.

Drawdown Restrictions :

Specific drawdown limits are imposed to prevent excessive losses. Traders who exceed these limits fail the challenge.

Profit Targets

Clear Profit Goals :

Traders are required to meet specific profit targets within a set period. These targets test the trader’s ability to generate consistent returns.

Timed Objectives :

Challenges are often time-bound, requiring traders to achieve targets within a designated period (e.g., 30 days). This tests their strategy under pressure.

Trading Rules Compliance

Risk Management Evaluation:

Traders are evaluated not only on profitability but also on their adherence to risk management rules. This includes setting stop-losses, managing position sizes, and avoiding over-leveraging.

Adherence to Regulations:

Some challenges include additional rules to ensure trading behavior aligns with regulatory standards and best practices.

Performance Review

Real-Time Monitoring :

The firm monitors each trader’s progress in real-time, tracking metrics like profit, loss, drawdown, and trade frequency.

Scorecard :

Traders receive a progress report or scorecard that shows their performance in relation to the challenge’s objectives. This transparency helps traders stay aware of their standing and make adjustments.

Evaluation and Final Decision

Pass or Fail Criteria:

At the end of the challenge, traders are assessed against all criteria. Only those who meet the profit target and stay within risk limits are eligible to progress.

Invitation to Next Phase :

Traders who succeed may either move on to a new, more challenging phase or be granted immediate access to funded accounts.

Step - 2

Access to Capital

Traders who pass the challenge gain access to the firm’s capital through funded accounts. This is a unique opportunity for traders to trade on behalf of the firm without using their own money.

Funded Accounts :

These accounts allow traders to execute trades using the firm’s capital.

Capital Allocation :

The amount of capital allocated may depend on the trader’s performance in the challenge (e.g., higher success rates may lead to larger allocations).

Risk-Sharing Mechanism :

The firm assumes the risk of capital loss, allowing traders to focus on performance without personal financial exposure.

Step - 3

Profit Sharing

After gaining access to funded accounts, traders have the opportunity to earn a share of the profits they generate

Profit Distribution :

Traders typically receive a substantial portion of the profits, often between 70-80%, as an incentive to maximize performance.

Firm’s Share :

The remaining percentage is retained by the firm to cover operational costs and reinvest in trading activities.

Performance-Based Scaling :

Traders who consistently meet or exceed profit targets may receive opportunities to scale their accounts, increasing both capital access and profit potential.

Step - 4

Revenue Maximization for Firms

Fund management firms have an additional advantage by replicating successful trades from funded traders, increasing overall returns without increasing payouts.

Strategy Replication:

The firm can replicate the trades of high-performing traders within its own accounts.

Revenue Retention :

Profits from these replicated trades go directly to the firm, creating an additional revenue stream.

Scalability :

This process allows firms to maximize returns without incurring additional profit-sharing obligations, enhancing their profitability.

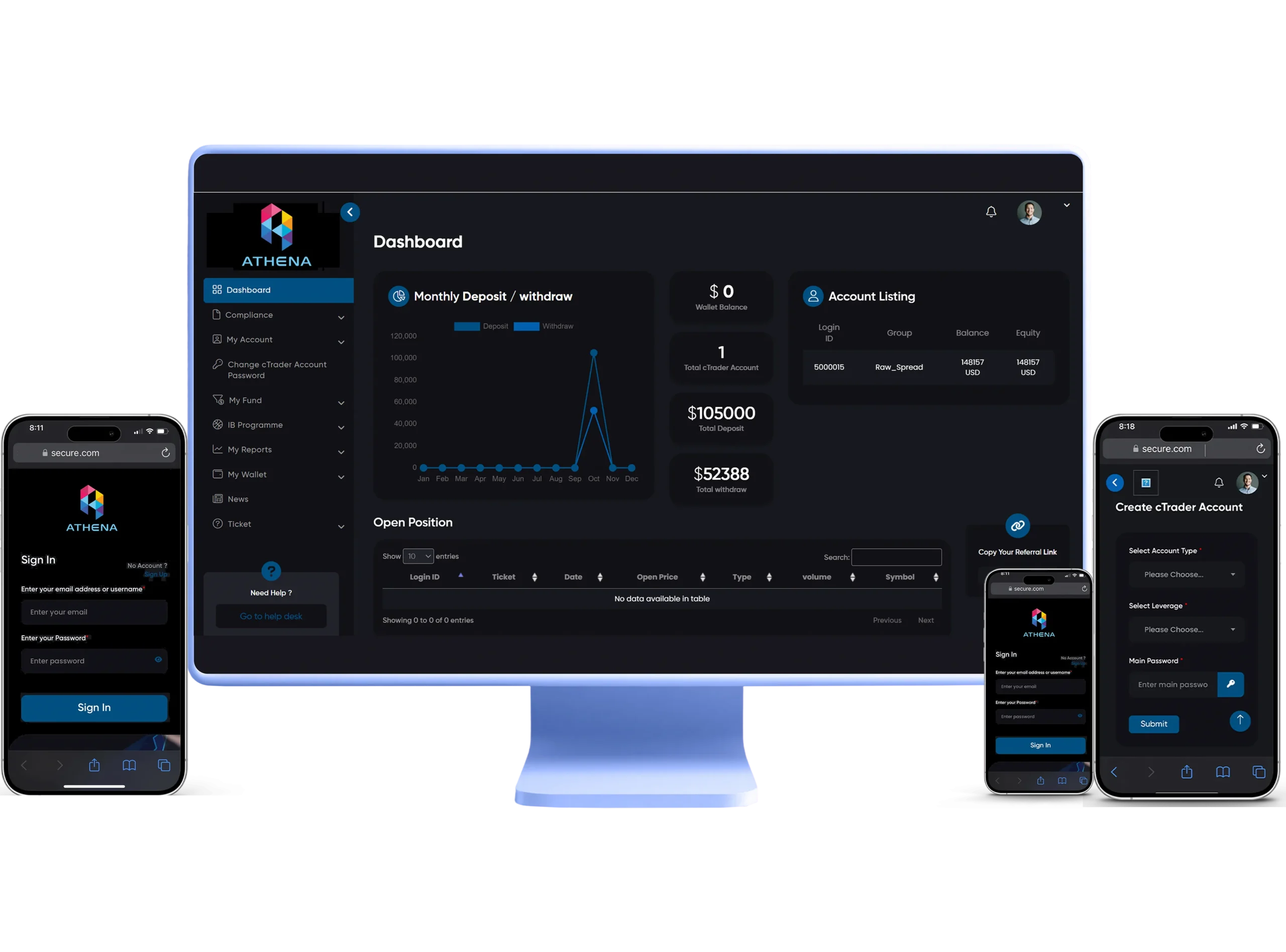

Benefits of Athena’s Fund Management Solution

Athena Technology’s fund management solution is tailored to meet the needs of both new and established trading firms. Our solution provides firms with a fast, scalable, and profitable way to attract talented traders while managing risk and maximizing lifetime client value. Here’s how Athena Technology’s fund management solution can benefit your firm:

Simple, quick setup with minimal regulatory hurdles

Athena’s fund management solution is designed for a quick launch, allowing firms to start operations with minimal setup time. Unlike traditional brokerage models, fund management often involves fewer regulatory complexities, allowing firms to bypass lengthy approval processes and start generating revenue sooner. With Athena’s end-to-end setup support, you can have your fund management firm up and running swiftly.

Target beginner to professional traders with low entry barriers

Athena’s fund management model appeals to a wide range of traders, from novices to seasoned professionals. By lowering the entry requirements and offering traders access to the firm’s capital, you can attract aspiring traders who lack substantial personal funds, as well as experienced traders looking to leverage additional capital. This flexible approach enables your firm to reach a larger and more diverse audience, growing your brand’s presence and reach within the trading community.

Reduced acquisition costs with recurring trader engagement

Fund management firms enjoy lower customer acquisition costs compared to traditional brokerage models, as the opportunity to trade with firm capital is a strong incentive that attracts talent organically. With Athena’s solution, traders are drawn to the challenge-based model and are likely to re-engage by participating in multiple challenges. This recurring engagement significantly reduces the need for extensive marketing budgets and helps firms achieve better returns on their marketing investments.

High repeat engagement as traders re-enter challenges

Athena’s fund management solution is designed for a quick launch, allowing firms to start operations with minimal setup time. Unlike traditional brokerage models, fund management often involves fewer regulatory complexities, allowing firms to bypass lengthy approval processes and start generating revenue sooner. With Athena’s end-to-end setup support, you can have your fund management firm up and running swiftly.

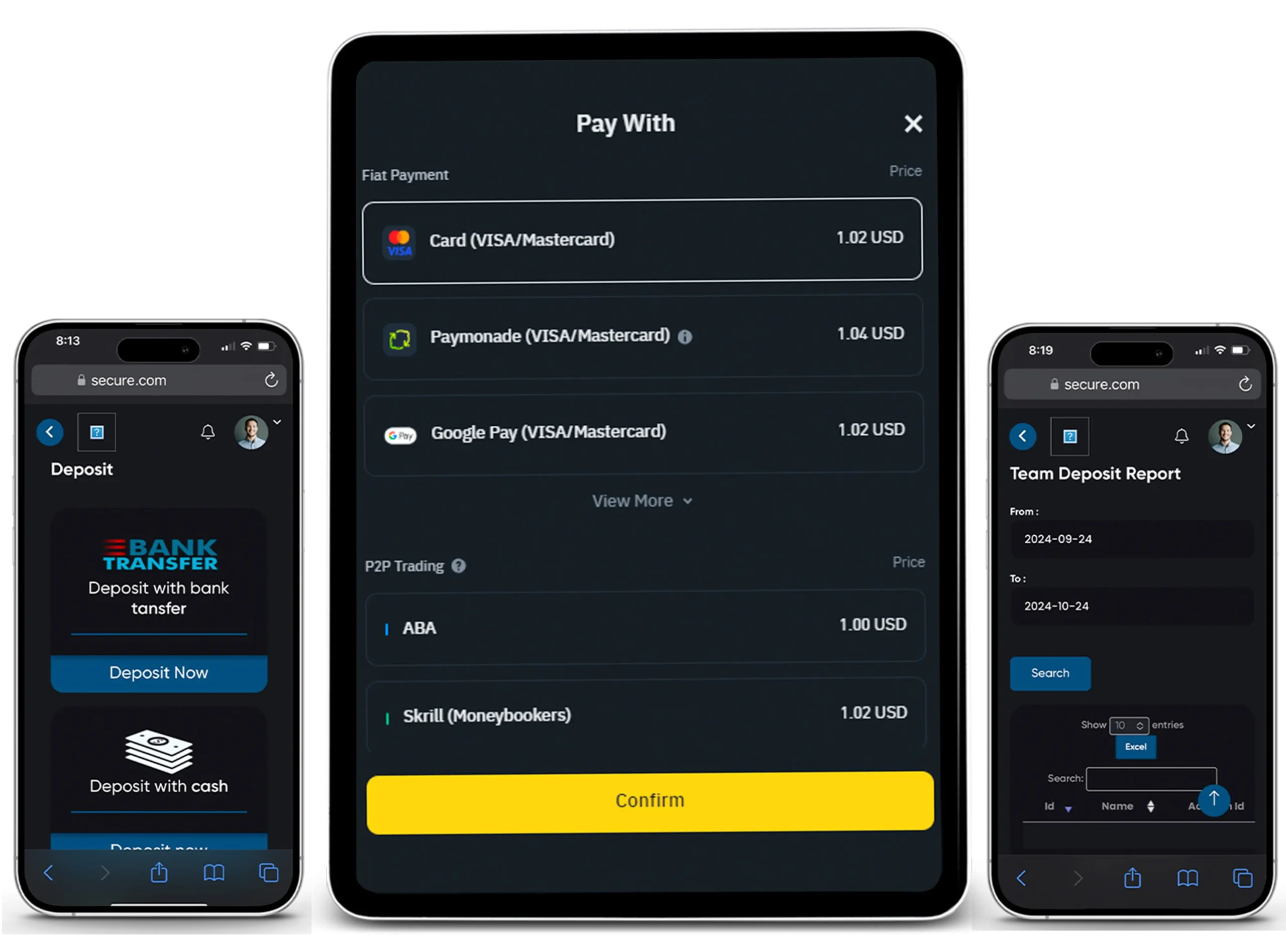

Tools to limit and manage risks with custom settings

Athena’s solution provides comprehensive risk management tools that allow firms to set specific trading limits, including daily loss limits, maximum drawdown, and position size restrictions. These customizable risk parameters give firms the flexibility to control exposure according to their risk tolerance. By empowering firms to adjust risk settings based on individual trader performance, Athena’s solution helps firms protect their capital while supporting traders in managing risks effectively.

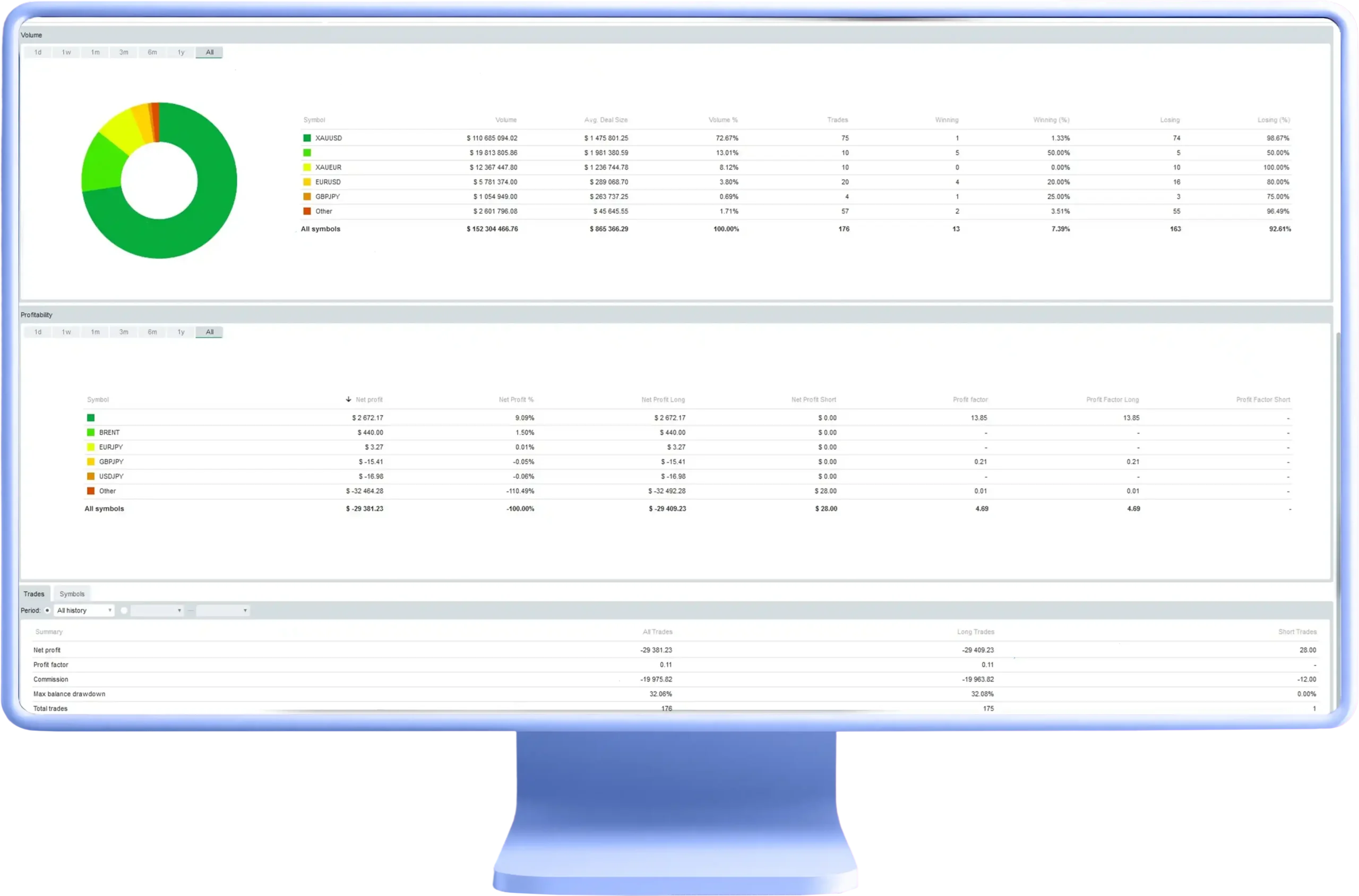

Athena’s Risk Management Tools

Athena Technology’s fund management solution provides powerful risk management features that help firms protect their capital and minimize exposure to losses. These tools ensure that both traders and firms operate within secure risk parameters, promoting sustainable growth and stability.

To prevent significant losses within a single trading session, Athena’s platform includes a daily risk limit. This limit is set as a percentage of account equity at the start of each day, capping potential losses and helping traders avoid substantial setbacks during any single trading period.

Athena’s cash loss limit safeguards initial investments by capping the total amount a trader can lose on their account. This feature calculates both floating (unrealized) and realized losses, ensuring that the trader’s overall losses remain within acceptable limits. By preventing excessive losses, this tool protects the firm’s capital and mitigates potential risk.

To control long-term risk, Athena’s solution includes a maximum drawdown limit, which restricts the account’s drawdown based on a pre-set percentage. This feature considers both the initial balance and accumulated profits, ensuring that gains are protected while maintaining risk exposure within safe boundaries. The max drawdown limit is an essential tool for firms to maintain capital security and encourage disciplined trading practices.